Industry News: Swedish Therapy Platforms Gain Ground in UK - Could US/AUS Markets Be Next?

As Swedish therapy platforms introduce new commission models and therapist-driven pricing, major platforms may need to evolve or lose ground. What might this mean for your practice?

In recent years, platforms like BetterHelp, Alma, HelloSelf and more have transformed how people access therapy, creating convenient digital pathways to mental health support. Thy have built massive user bases, brand recognition, and technological infrastructure that have helped millions connect with therapists. But they’ve also impacted therapist fees and commission.

Now, a new wave of mental health platforms from Sweden is entering the market. While some elements of their approach may represent improvements for both therapists and clients, other aspects remain unproven at scale.

Want to discover how these Swedish platforms are revolutionising therapist compensation (for the better and worse) with their new therapy platforms and commission models? Continue reading to get an exclusive breakdown of the new services, their matching algorithms, how they are different to directories and agencies, and what it could mean for your CBT practice. Plus, learn which approach might give you the best financial return in the long term. Upgrade now for the price of a coffee to access the full analysis!

Key Players to Watch

Lavendla

Founded in Stockholm in 2014, according to their website Lavendla has established itself as the leading mental health digital platform in the Nordics. While they operate in multiple service areas, their mental health arm of their company is the first of their model that has come to the UK.

Their growth has been supported by significant investor confidence, and their platform offers several distinctive features:

Therapist-centric model: Unlike other platforms that downplay individual practitioners, Lavendla emphasises the therapist's personal brand and unique expertise

Selection process: they claim not just any therapist can sign up unlike directories, practitioners are chosen not just for credentials but for alignment with core values of "sensitivity, courage, and drive"

Customer satisfaction: The currently have a 4.7/5 star rating on Trustpilot

Packages: New to the UK therapy market is the ability to buy more sessions at a discounted rate. For example, on some Lavendla therapist pages if you buy 5 sessions that saves you a percentage of the overall fee.

Meela

Founded in 2021, Meela addresses one of the most common pain points in accessing mental health support: finding the right therapist match.

Meela was born from the British-born, Sweden-based founders' personal experiences with the challenges of accessing mental health support and the frustration of therapist trial and error.

Key features of Meela's platform:

Research-based matching technology: Meela claims to use evidence-based approaches to connect clients with appropriate therapists and therapy methods

Focus on compatibility: Their system emphasises fit between client and therapist, not just availability or credentials

Inclusive approach: The platform explicitly welcomes users of all backgrounds, identities, and orientations

What sets Meela apart is their emphasis on research-backed approaches to therapist matching. For example, when you go to find a therapist on Meela, the first question isn’t your location of availability, but what your main difficulty is, followed by what you would actually like to get from therapy.

However, Meela also asks questions such as what would you prefer your therapists’ gender, age, cultural background etc… to be. Whilst this is beneficial for clients looking for therapists with shared experience, it also raises questions around exclusion of some therapists due to their demographic.

The Evolution of Mental Health Platform Business Models

What's particularly noteworthy about these Swedish companies is how they're pioneering a third business model in the digital therapy space:

Directory model - Platforms like Psychology Today and Counselling Directory function as listings where therapists pay a flat fee for visibility, but handle all client relationships and payments independently.

Commission model - Platforms that function as intermediaries, taking an ongoing percentage of fixed session fees in exchange for client acquisition, marketing and platform tools (e.g. BetterHelp etc.)

Matchmaking model - Companies like Meela and Lavendla are focusing on matching therapist and client, with progressive commission structures, allowing therapists to set their own fees while still providing technological infrastructure.

This third approach represents a significant shift from current platforms.

Commission Structures: A Closer Look

The financial relationship between therapists and platforms is perhaps one of the most significant differentiators in the market. The emerging Swedish approach, introduces a different model:

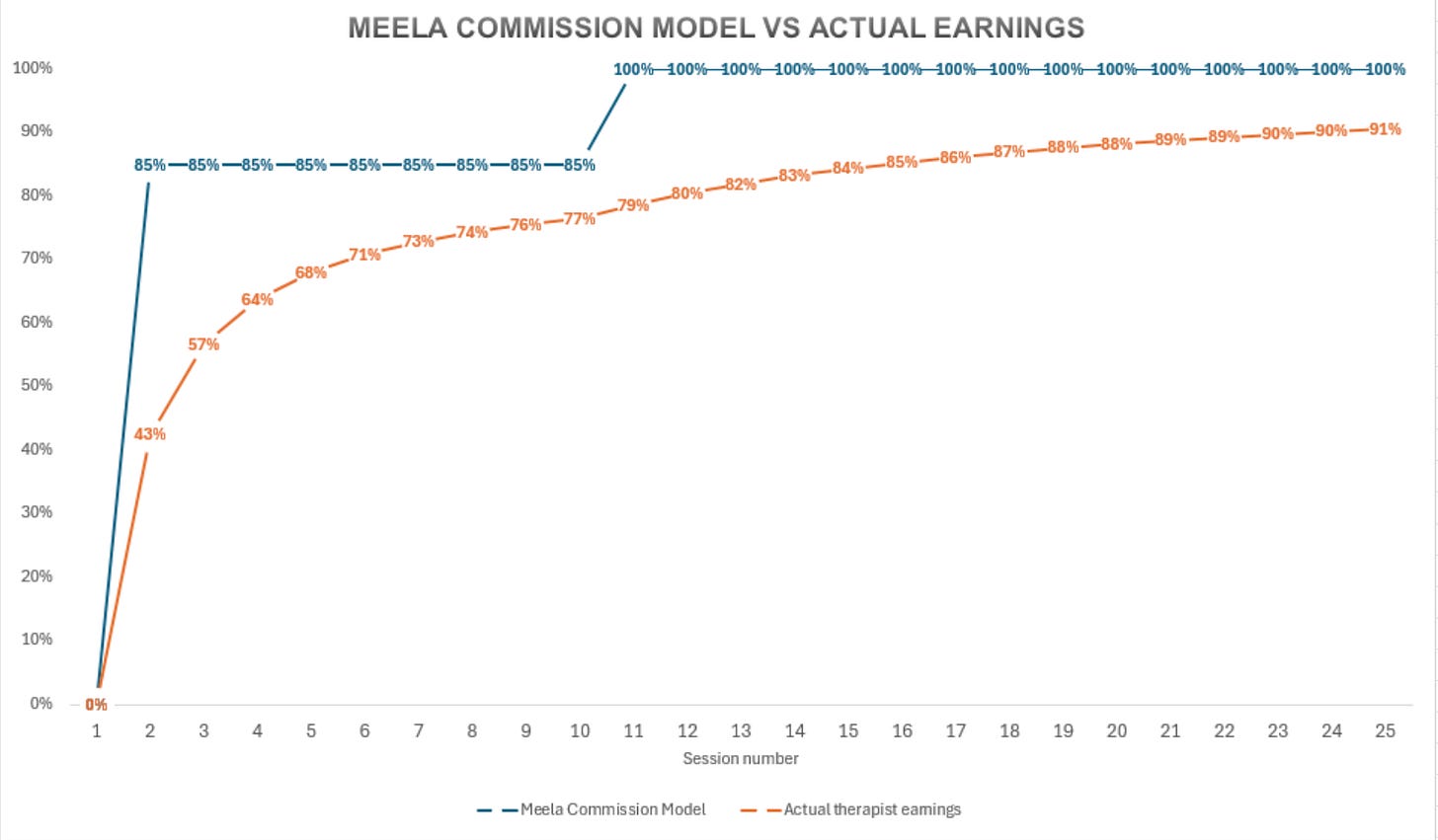

The below was posted on a British facebook group for CBT therapists, which broke down Meela’s commission structure:

First session: Meela retains 100% of the first session fee

Sessions 2-10: A 15% commission applies

After ten sessions: No commission is charged; therapists keep all earnings

Single session clients: No fee if a client attends only one session

This commission structure acknowledges different value propositions at different stages of the therapeutic relationship.

While we don't have official data on Lavendla's exact fee structure, industry sources suggest it follows a similar approach.

With this type of model, it appears two things become important as to whether it is financially sustainable for therapists:

The length at which you expect to see a client (e.g. very short term may not be financially viable)

Your fee

Example 1: Less Financially Viable (Client attends only 3 sessions)

You charge £100 per session and have a client who only attends 3 sessions:

Session 1: Meela retains 100% of fee

You earn: £0

Meela earns: £100

Session 2: 15% commission

You earn: £85 (£100 - 15%)

Meela earns: £15

Session 3: 15% commission

You earn: £85 (£100 - 15%)

Meela earns: £15

Total earnings:

Your total: £170 (from 3 sessions)

Meela's total: £130

Your average per session: £56.67

If the client stops after just 3 sessions, your average per sessions is just over half of your actual fee.

Example 2: Financially Viable (Client attends 20 sessions)

Let's consider a client who attends 20 sessions at £100 per session:

Session 1: Meela retains 100% of fee

You earn: £0

Meela earns: £100

Sessions 2-10: 15% commission on each

You earn: £85 per session × 9 sessions = £765

Meela earns: £15 per session × 9 sessions = £135

Sessions 11-20: No commission

You earn: £100 per session × 10 sessions = £1,000

Meela earns: £0

Total earnings:

Your total: £1,765 (from 20 sessions)

Meela's total: £235

Your average per session: £88.25

In this scenario, the commission structure works much better for you. As the relationship continues, your average earnings per session increase significantly.

The longer the therapeutic relationship continues, the better your average earnings become under this commission structure — but averaged out they are still not your actual fee. It therefore may be worth charging higher than your fee on these platforms, so that your averaged fee works out to be your actual fee.

Matching - A Good or Bad Thing?

These platforms emphasise the importance of matching (particularly Meela), with the intention to make the therapeutic relationship more effective. Meela allows clients to select preferences like therapist gender, culture, ethnicity, and age range, but does this really lead to better therapeutic outcomes? According to Meela’s research and approach - yes!

However, many experienced therapists have witnessed how seemingly mismatched pairings sometimes create the most productive therapeutic relationships. Indeed, often having someone very different from you can help with gaining a different perspective. Yet, from a consumer side, why not have your ultimate match? In this way clients are being empowered to really think and explore what type of therapist would help them, rather than the next available therapist.

The future remains to be seen.

Implications for CBT Practitioners

For cognitive-behavioural therapists specifically, these Swedish platforms present both opportunities and considerations:

Potential Benefits:

Financial model flexibility: The declining commission structures may benefit therapists who typically work with clients for longer treatment courses and who charge different rates, rather than agreeing to pre-set rates

Professional autonomy: The emphasis on therapist independence allows you to do what you do best without platform interference

Therapist matching: Both platforms focus on matching client and therapist on expertise and speciality, rather than the next available therapist

Potential Drawbacks:

Less established client base: Newer platforms may not yet have the volume of potential clients that larger established platforms provide (although Meela’s marketing campaigns are pretty large!)

Uncertain longevity: As with any newer business model, there's less certainty about long-term stability compared to established players

Limited track record: While these companies make compelling claims, outcomes and satisfaction rates are still developing

The Future Landscape

As these Swedish companies continue expanding, they're likely to influence the broader therapy platform market. Their focus on research-based matching and capped commission structures may pressure established platforms to evolve their own models.

For CBT practitioners evaluating where to establish their digital presence, the emergence of these alternatives creates more options but also more complexity in decision-making.

The ideal approach may involve maintaining a presence across multiple platform types while closely monitoring which provides the best balance of client flow, autonomy, and financial terms.

What seems clear is that the therapy platform landscape continues to evolve rapidly, with new business models challenging assumptions about how digital therapy should function.

Whether these Swedish companies ultimately disrupt the established players or simply carve out specific niches, they're contributing to a more diverse ecosystem that gives therapists more choices for how they practice digitally.

Now they’ve branched into the UK from Sweden and the Nordics, will they move on to other large English speaking therapy markets - like AUS, NZ and the USA? It appears it might be on the way.

As this space continues to evolve, one thing remains clear: the companies that will ultimately succeed are those that recognise therapists as partners rather than simply service providers on their platforms.

What do you think? Have you joined these platforms? Do you prefer their structure compared to others?